- On September 12, 2025, Ralph Lauren Corporation announced its Board of Directors has declared a regular quarterly dividend of US$0.9125 per share, payable on October 10, 2025, to shareholders of record as of September 26, 2025.

- Microsoft announced the launch of ‘Ask Ralph,’ an AI-powered conversational shopping tool developed with Ralph Lauren, aiming to personalize retail experiences and expand the brand’s digital customer engagement across more markets and labels.

- We’ll explore how the introduction of an AI-driven shopping assistant could influence Ralph Lauren’s digital expansion and brand strategy.

Find companies with promising cash flow potential yet trading below their fair value.

Ralph Lauren Investment Narrative Recap

To be a shareholder in Ralph Lauren today, you need to believe in the company’s worldwide appeal, ability to capture premium pricing, and ongoing digital evolution. The recently announced ‘Ask Ralph’ AI shopping assistant, developed with Microsoft, highlights Ralph Lauren’s push toward digital customer engagement, but does not materially change the fact that the most important short-term catalyst remains international and direct-to-consumer growth, while the biggest risk remains US consumer sensitivity to pricing and macro conditions.

The September 12 dividend declaration of US$0.9125 per share affirms the company’s shareholder return focus, building on a 10% increase earlier this year and ongoing share repurchases. While these announcements reinforce confidence, their impact is routine compared to the potential influence of technology-enabled channel expansion, which directly addresses critical catalysts around digital and international growth.

However, investors should also be aware that if consumer price sensitivity in the US increases, it could force…

Read the full narrative on Ralph Lauren (it’s free!)

Ralph Lauren’s narrative projects $8.4 billion in revenue and $1.0 billion in earnings by 2028. This requires 5.0% yearly revenue growth and a $205 million earnings increase from the current $794.7 million.

Uncover how Ralph Lauren’s forecasts yield a $340.81 fair value, a 8% upside to its current price.

Exploring Other Perspectives

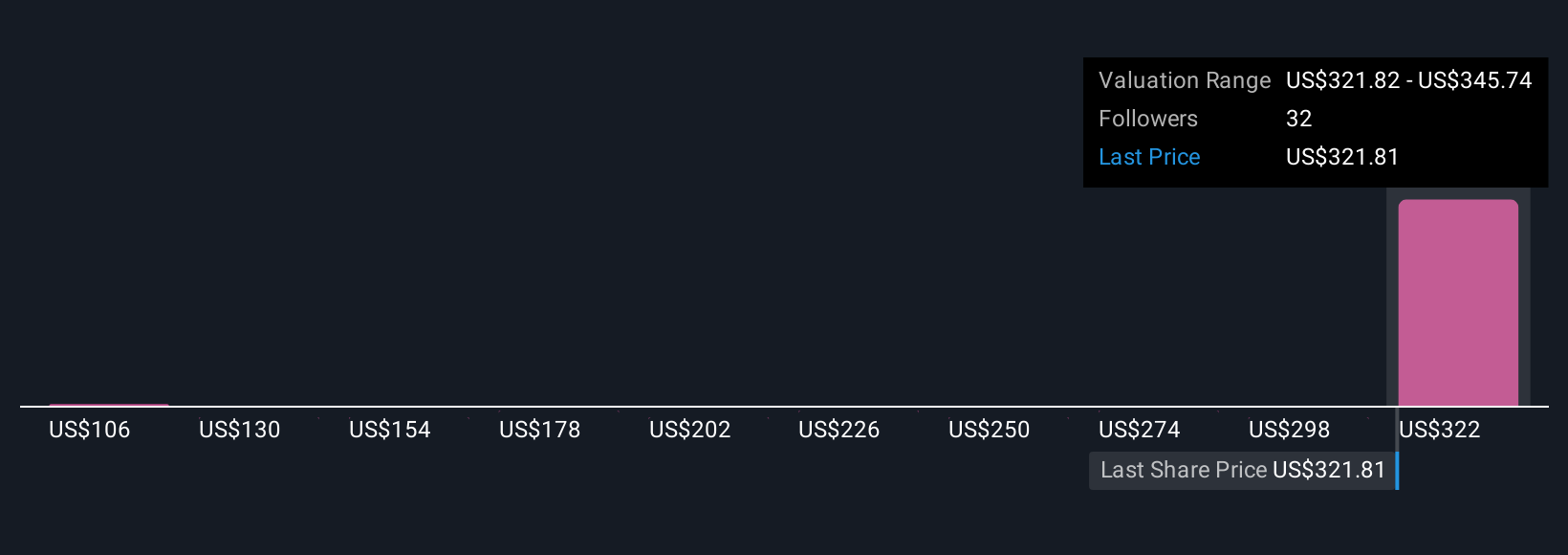

Simply Wall St Community members offered seven unique fair value estimates for Ralph Lauren, ranging from US$106.47 to US$376.87. Against this diversity of opinion, risks of muted US demand or pricing pressure could weigh on the premium brand’s earnings, so consider these varied viewpoints as you weigh your own outlook.

Explore 7 other fair value estimates on Ralph Lauren – why the stock might be worth less than half the current price!

Build Your Own Ralph Lauren Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Source link